Manufacturing

The Manufacturing Economic Update

Dr. Chad Moutray

Chief Economist - National Association of Manufactures

Director, Center for Manufacturing Research - The Manufacturing Institute

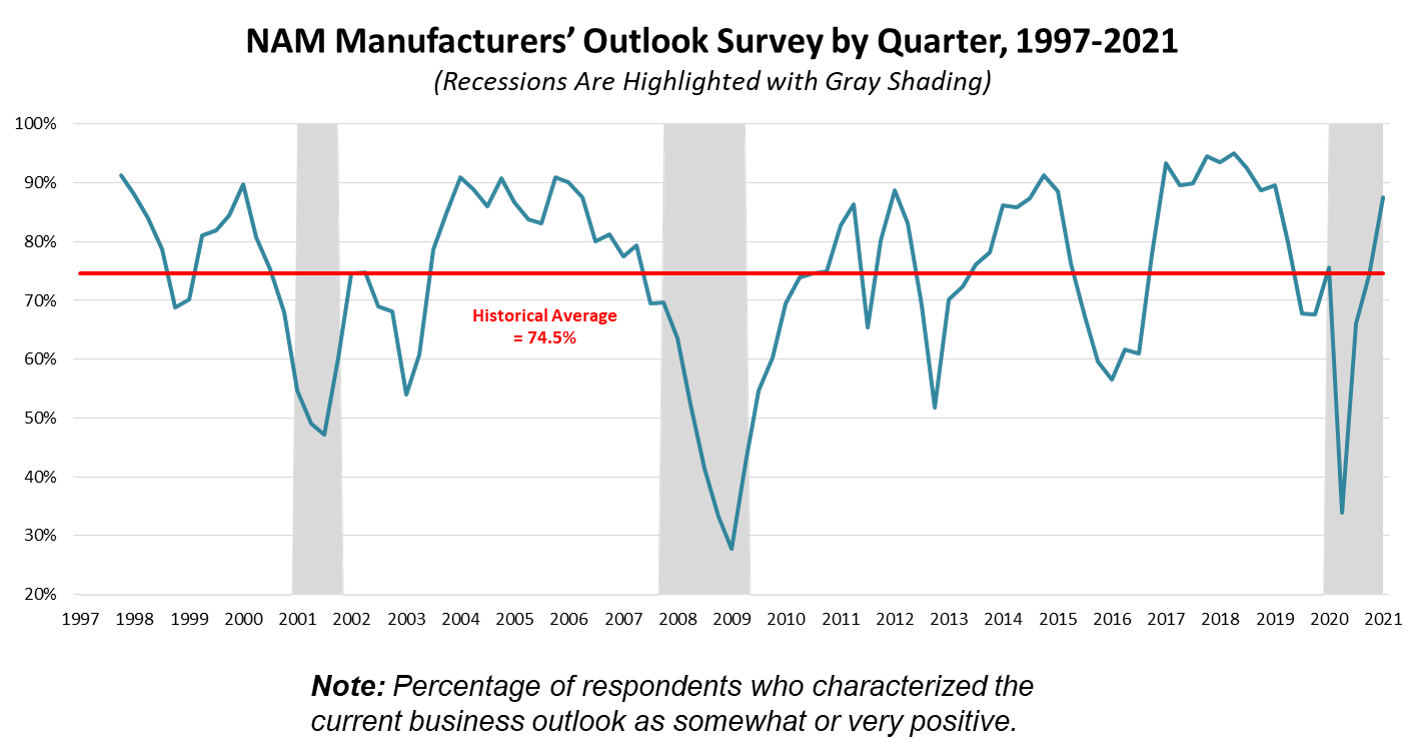

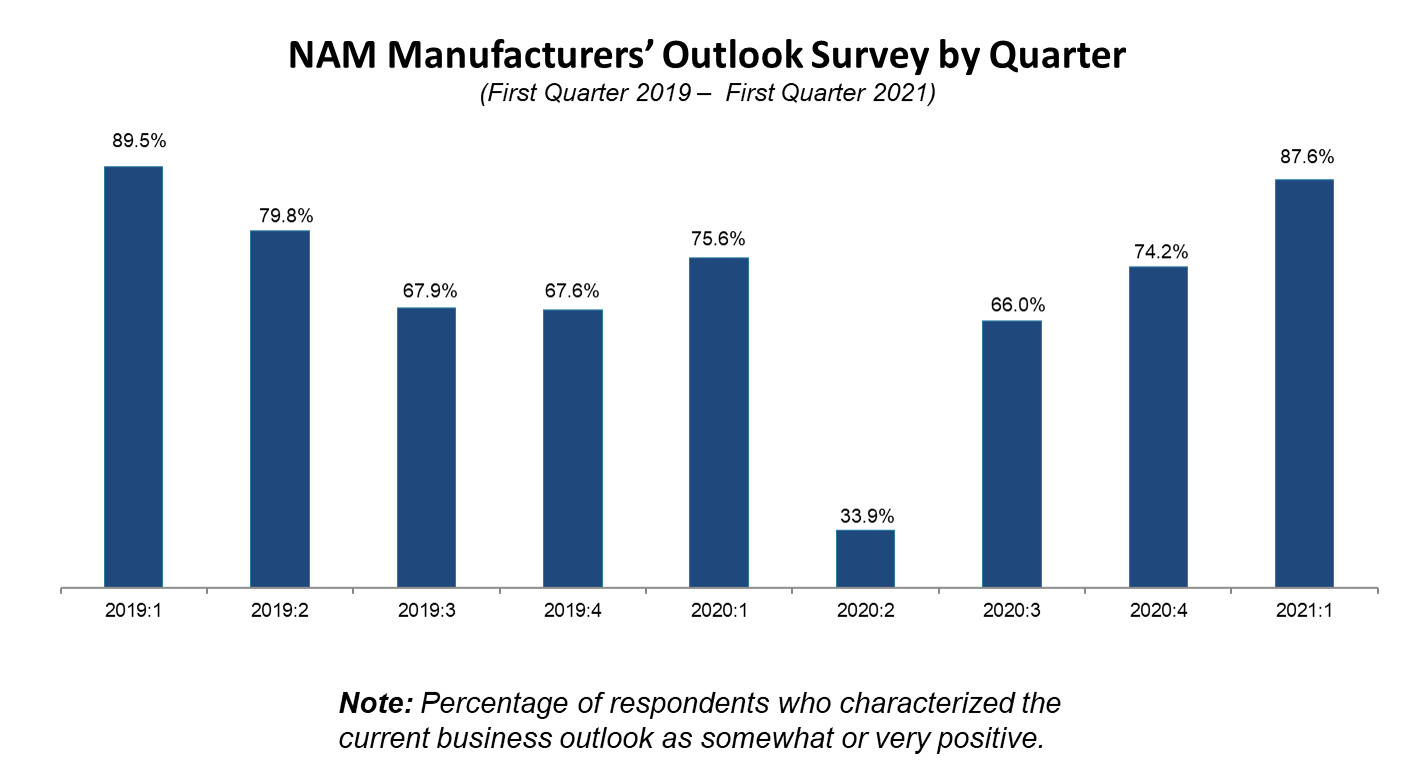

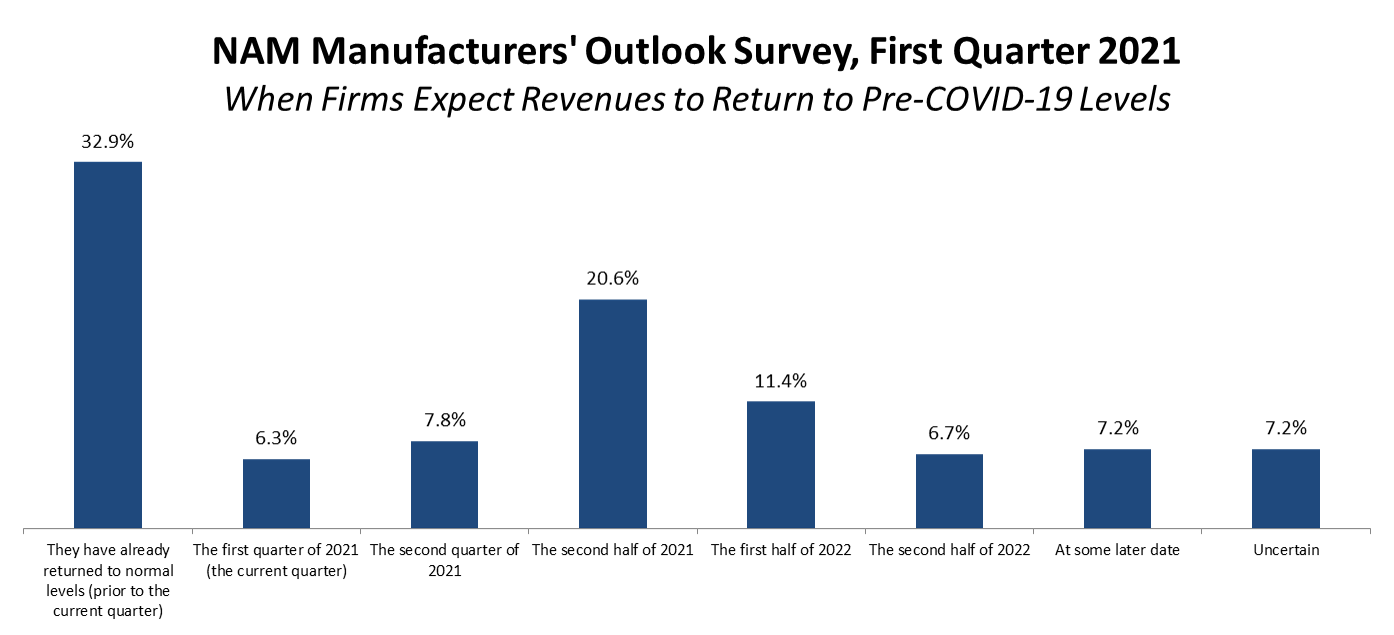

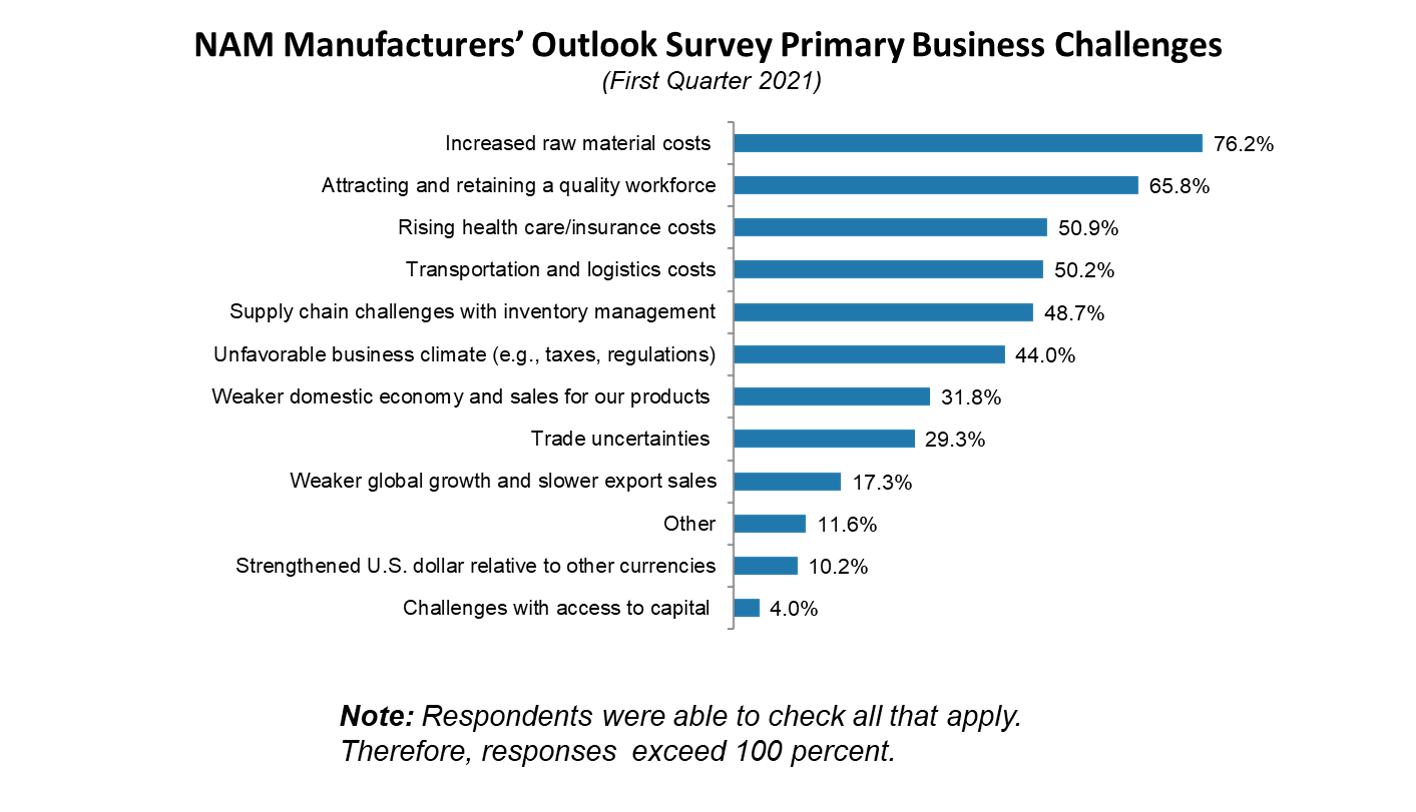

NAM Manufacturing Outlook Survey - 1st QTR 2021

NAM Manufacturing Outlook Survey - 2nd QTR 2021

NAM Manufacturing Outlook Survey - 3rd QTR 2021

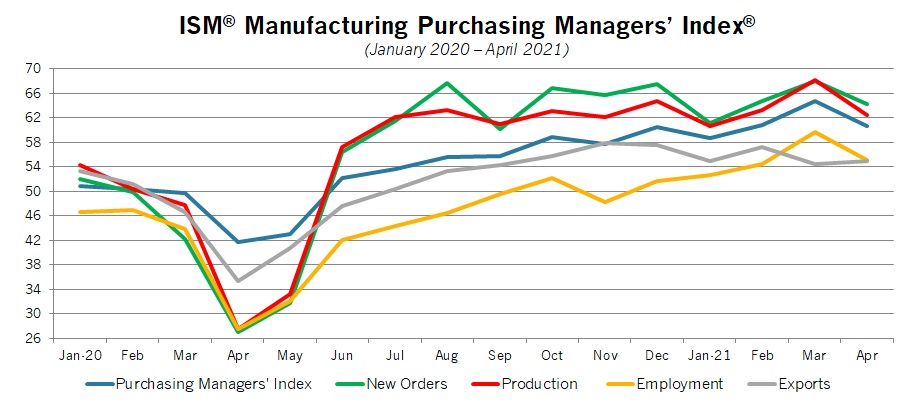

After expanding in March at the fastest pace since December 1983, the @ism reported that manufacturing activity eased a bit in April, but with growth continuing to be robust overall. The headline index pulled back from 64.7 in March to 60.7 in April.

After expanding in March at the fastest pace since December 1983, the @ism reported that manufacturing activity eased a bit in April, but with growth continuing to be robust overall. The headline index pulled back from 64.7 in March to 60.7 in April.

Trade-Weighted U.S. Dollar Index Against Broad Index of Currencies, Goods and Services, 2014–2020

(Currency Units per U.S. Dollar, January 2006=100)

Source: Federal Reserve Board